Commodity Market Recap Week #29

Last Week’s Commodity Highlights and How to Predict What’s Next

Dear Readers of The Merchant’s News,

📈 Are supply shocks outpacing demand worries?

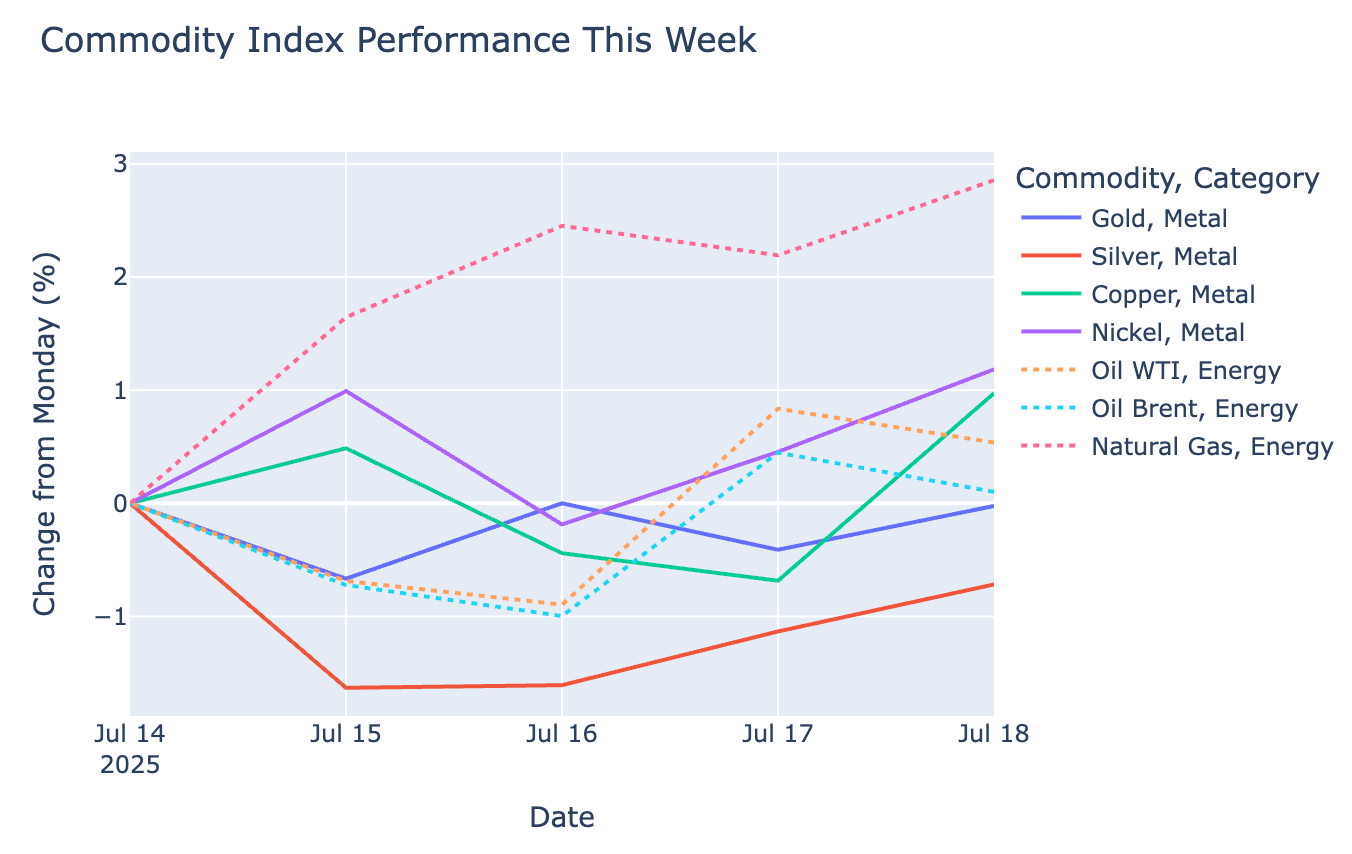

🛢️ Crude Oil: Brent crude settled near $69–70/bbl and WTI at $67.3 on July 18, roughly 1% lower on the week, as Iranian-backed drone strikes on Iraqi oilfields and a new EU price cap on Russian oil initially buoyed prices. Meanwhile, OPEC+ continues to add output.

🔥 Natural Gas: U.S. Henry Hub gas surged ~9% to about $3.56/MMBtu by July 18, hitting a 3-week high, driven by record summer heat and robust LNG exports.

🥇 Metals: Precious metals climbed: Gold hovered around $3,339 (+0.5%) and silver about $38.5 (+1.2%) on safe-haven flows. In contrast, base metals were muted – LME copper traded near $9,650/ton, nickel at ~$15,218 (up only 0.8% on the day)– pressured by U.S. tariff uncertainties and ample stockpiles.

💼 Consulting Opportunity

Need tailored commodity insights?

The Merchant’s News offers bespoke research and strategic consulting for private clients. Our experts can provide personalized reports, data access, and direct advisory to help you navigate these complex markets. write us an email here: giacomo@themerchantsnews.com to learn more about our premium consulting services.

The Big Picture

Global commodities were driven by a tug-of-war between supply disruptions and demand signals.

Oil prices initially rallied midweek as drone attacks knocked out Iraqi output and the EU imposed a tighter price cap on Russian crude.

Brent spiked above $70 before profit-taking pushed it back to the $69–70 range by Friday. OPEC+’s repeated output hikes (411 kbpd per month for May–July) kept a lid on further gains, while a surprise 3.9-million-barrel U.S. crude drawdown lent some support late in the week.

Natural gas saw a powerful rally: benchmark U.S. futures hit $3.606 (up ~2% intraday) on July 18, marking a three-week high. Scorching heat across the U.S. drove unprecedented power demand, tightening supplies despite record production. For the week, Henry Hub was up roughly 9%, reversing a month-long slump and confirming summer’s strong seasonal demand.

Precious metals continued their upward drift. Gold held around $3,338 (+0.5%) as investors parked money in havens amid trade-war tensions and hopes for future Fed rate cuts. Silver hit roughly $38.46 by Friday – a 14-year high – buoyed by industrial demand and safe-haven flows. The narrative: “Uncertainty premium” returned to the market, similar to mid-week when fresh U.S. tariffs helped gold to earlier seven-month highs.

Base metals diverged. Copper remained elevated due to a frantic pre-tariff scramble: LME copper stood near $9,650/t on Wednesday. (CME/COMEX contracts had briefly hit record highs on July 9 after Trump’s 50% copper tariff announcement, then retreated as the U.S. premium surged) Supply-chain disruptions (e.g. delayed shipments) kept LME inventories tight, but traders await tariff details and Chinese demand cues. Nickel is a special case: despite rising output and record LME stocks (now over 200k tonnes), the price languished near four-year lows (~$15,200). In short, metals are in two camps: inflation-hedge metals (gold, silver) enjoying a bid, versus cyclical metals (copper, nickel) stuck under trade-war pressure and oversupply.

Unlock Your Strategic Edge 🔓

Ready to move beyond the "what happened" and discover the "what's next"? Our premium analysis delivers three critical advantages:

Actionable Forecast: Quarterly price targets for energy and metals

Deep-Dive Thesis: In-depth analysis of the gulf between safe-haven precious metals and struggling base metals. We unpack the contrarian case that commodities remain undervalued amid structural scarcity.

Future Scenarios: Five potential market paths: from “Fed cuts fuel a commodity rally” to “Global slowdown dampens demand.” We detail how each would impact key assets.

Keep reading with a 7-day free trial

Subscribe to The Merchant's News to keep reading this post and get 7 days of free access to the full post archives.