The Largest US $340B Revenue Oil Company

Decoding the Energy Giant's $270.6 Billion Equity Powerhouse and $23 Billion Liquidity with a 3.5% Dividend Yield

Dear Readers of The Merchant’s News,

You're about to unlock the secrets of an energy giant that has not only weathered the storms of a volatile market but emerged stronger, wealthier, and more resilient than ever before. This is a financial fortress, strategically positioned to ride the waves of commodity surges while offering unparalleled stability against economic headwinds.

Imagine a company whose financial reserves have grown six-fold, a powerhouse with an ironclad balance sheet that laughs in the face of market uncertainty. A company that isn't just surviving but thriving, actively investing in high-growth frontiers like Guyana, securing its dominance for decades to come.

This is a meticulously crafted guide, brimming with actionable insights and detailed analysis that reveals why ExxonMobil stands as a compelling opportunity for shrewd investors. We'll expose the strategic genius behind its integrated model, and uncover the hidden value that the market is currently overlooking.

Are you ready to discover a true titan of industry, poised for remarkable returns and enduring stability? Your journey into the heart of ExxonMobil's investment potential begins now.

Subscribe to The Merchant’s News to unlock the rest

A subscription gets you:

✅ Subscriber-only posts and full archive

✅Our deep dive analysis

Building a Financial Fortress and Seizing Opportunities

Imagine you're looking to invest in a company that's not just doing well now, but is built to last. That's ExxonMobil. Think of them as a seasoned builder who's spent years strengthening the foundation of their house. Between 2016 and the first quarter of 2025, they've done just that, building up their own money (what we call equity) and accumulating a massive pile of cash. This isn't just about showing off; it means they're incredibly stable and ready for whatever the unpredictable energy market throws their way.

Right now, the energy market is buzzing. Prices for oil and natural gas are on the rise (or have shown recent strength), which is fantastic news for ExxonMobil because it directly boosts their profits. What makes them particularly robust is their "Swiss Army knife" business model. They're not just about drilling; they're also refining oil into products like gasoline and making chemicals. This diverse approach means they can make money when prices are high, but also weather the storm if prices drop. Plus, they're smart about where they put their money, investing in promising, low-cost areas like the Guyana oil fields and Permian Basin, which are set to add tremendous long-term value.

Here's what really stands out when we look at ExxonMobil:

Rock-Solid Finances:

Their own money (equity) has surged from $176.8 billion in 2016 to $269.8 billion in Q1 2025. Even more impressively, their cash reserves are significantly higher than historical levels, standing at $18.5 billion in Q1 2025. This gives them immense flexibility and a deep cushion against any market shocks.

Boost from Energy Prices (Q1 2025 Perspective):

While crude oil prices in Q1 2025 averaged slightly lower than late 2024, natural gas prices in Q1 2025 saw a notable increase compared to Q4 2024, which is a positive for ExxonMobil given its significant natural gas production. Overall production volumes, particularly from advantaged assets, contributed positively.

Built for Any Economic Weather:

Whether oil is soaring at $100 a barrel or dipping lower, ExxonMobil's integrated business model allows them to perform much better than companies that only focus on drilling. Their different segments balance each other out.

Appealing Investment Value:

The company's stock currently appears to be undervalued compared to what it's truly worth and how other companies in its sector are priced. It also offers a very attractive 3.5% dividend yield (a regular payment to shareholders) and they're actively buying back their own shares. All of this adds up to a compelling return for investors.

In essence, if you're searching for a stable, long-term investment in the energy sector that offers both strong returns and impressive financial resilience, ExxonMobil presents a very persuasive case.

How ExxonMobil Forged Its Strength: A Closer Look at the Money (Updated for Q1 2025)

Let's dive a bit deeper into how ExxonMobil has become such a financial powerhouse over the past years, up to the most recent quarter. It's a story of strategic transformation, building resilience, and setting the stage for future growth.

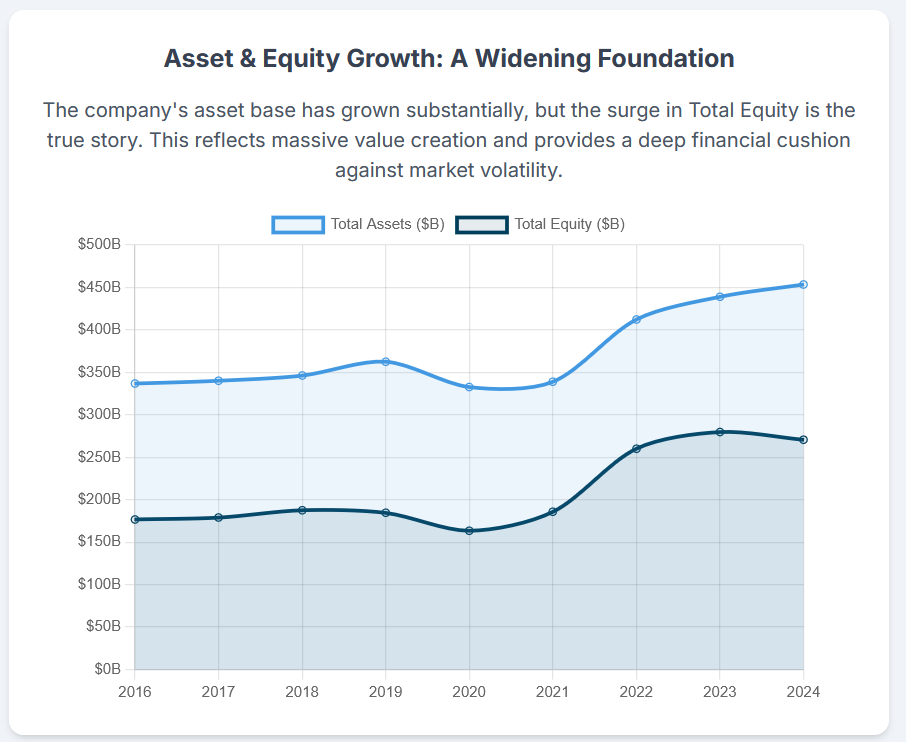

Growing Assets and Expanding Their Reach

Think of assets as everything a company owns, from physical buildings to oil reserves. ExxonMobil's total assets have grown significantly, from $336.8 billion in 2016 to $451.9 billion in Q1 2025. This expansion shows they've been consistently investing and growing their operations.

A key part of this growth is their Property, Plant & Equipment (PP&E), which represents their physical infrastructure like oil rigs, refineries, and pipelines. In Q1 2025, their net PP&E was $292.6 billion, showing continued significant investment in their core business for the long haul. For a company like ExxonMobil, investing in PP&E is like a farmer buying new, more efficient tractors it's crucial for future harvests.

Equity Growth: The Foundation of Shareholder Value

The growth in Total Equity is arguably the most telling sign of ExxonMobil's financial health. Equity is essentially the portion of the company owned by its shareholders after all debts are accounted for. This figure soared from $176.8 billion in 2016 to an impressive $269.8 billion in Q1 2025. This isn't just a positive development; it signifies a massive increase in the intrinsic value owned by you, the investor.

This rapid growth in equity, especially in recent years, is a direct result of strong internal capital generation. Simply put, they've been incredibly good at making and keeping money from their core operations, particularly when commodity prices were favorable. This swelling equity acts as a powerful financial cushion, providing a much larger buffer against any future economic slowdowns, sudden drops in commodity prices, or unexpected operational challenges. Furthermore, a strong equity base makes it easier and cheaper for ExxonMobil to borrow money if they need to for big projects or acquisitions, without becoming overly risky. It's a clear signal of robust financial management and a very solid foundation.

A Significant Pile of Cash: Unmatched Flexibility

ExxonMobil's cash and cash equivalents stood at $18.5 billion at the end of Q1 2025 (this includes restricted cash). While slightly lower than the very high peak at the end of 2024 ($23.0 billion), it's still vastly higher than historical levels (e.g., $3.7 billion in 2016).

This substantial cash reserve isn't just sitting idle; it's a dynamic tool that gives ExxonMobil immense liquidity and operational flexibility. What can they do with all this cash?

Maintain and potentially increase their dividends:

They declared a $0.99 per share dividend for Q2 2025, payable in June 2025, continuing their long streak. This means more consistent payments to you, the investor, even during challenging market periods, making the stock attractive for income-focused portfolios.

Execute significant share buybacks:

In Q1 2025, they distributed $4.8 billion in share repurchases, consistent with their annual $20 billion share-repurchase program through 2026. By repurchasing their own shares, they reduce the number of outstanding shares, which often boosts the value of your existing shares.

Fund strategic investments or acquisitions:

They can pursue new, profitable projects or buy other companies without needing to take on a lot of new debt, giving them a competitive edge.

Absorb unexpected shocks:

This cash acts as a crucial safety net, allowing them to handle unforeseen expenses or market disruptions without financial strain.

This level of financial flexibility directly flows from their strengthened balance sheet and demonstrates a company that's not just surviving, but actively thriving and strategically managing its capital for long-term benefit.

Less Debt, Better Credit: Smart Financial Management

ExxonMobil's Total Debt (long-term debt plus notes and loans payable) was $37.6 billion in Q1 2025 (net debt was $37.6 billion less $17.0 billion of cash and cash equivalents excluding restricted cash). They repaid $4.6 billion in debt in Q1 2025, showing continued commitment to reducing their leverage. Even though total debt is higher than in 2016, the crucial point is that their Total Equity has grown much faster. This means the company is now significantly less reliant on borrowed money relative to its own capital compared to a few years ago.

Their current debt-to-capital ratio of 12% and net-debt-to-capital ratio of 7% are industry-leading, and they boast a strong AA credit rating. These indicators are incredibly important because they translate into several key advantages:

Lower borrowing costs: They can get loans at better interest rates, saving money.

Easier access to capital: They can raise funds more readily from financial markets if needed for large-scale projects like the expansion in Guyana.

Greater resilience in economic downturns: Less debt means less financial pressure when times get tough.

A sign of prudent management: This gives confidence to both investors and credit rating agencies, making the company's stock more appealing.

Things to Keep a Close Eye On

While ExxonMobil's financial picture is overwhelmingly strong, a balanced view also means looking at a few areas that warrant continued observation:

Total Liabilities:

This represents what the company owes. Total liabilities were $182.1 billion in Q1 2025. While this is an increase from 2016, it's important to remember that their total assets and equity grew much more. So, the overall burden of liabilities, relative to the company's size, has actually decreased. It's something to monitor, but not a major concern.

Accounts Receivable (AR) Growth:

This is the money owed to ExxonMobil by its customers for goods and services already delivered. AR increased to $46.3 billion in Q1 2025 from $43.68 billion at the end of 2024. While strong sales can lead to higher AR, it's essential that customers pay their bills efficiently. If it takes too long for them to collect this money, it can tie up cash flow. Given that revenue dipped slightly in Q1 2025 compared to previous strong quarters, ensuring efficient collections is even more important.

Cash and PP&E Dynamics:

The slight decrease in cash from Q4 2024 to Q1 2025, alongside continued high capital expenditures ($5.9 billion in Q1 2025), suggests strategic use of funds. This indicates disciplined capital allocation towards investments in their core business (like their Guyana projects) and debt repayment, rather than a deterioration of financial health.

How Global Energy Prices Impact ExxonMobil: Riding the Waves

ExxonMobil's financial success is deeply connected to the prices of crude oil and natural gas around the world. Let's see what's been happening in the most recent quarter and what it means for the company.

Crude Oil's Performance: Stable but with a Slight Dip

The crude oil market saw Brent crude prices average around $75.04 per barrel in Q1 2025, a slight decrease from Q4 2024 ($74.00) but still above the Q1 2024 average ($81.95). While prices have been relatively stable in early 2025, some analysts note a pull-back in spot prices post-Q1.

Natural Gas Performance: The Consistent Performer with Recent Strength

In contrast to oil, natural gas prices (Henry Hub) showed a notable increase in Q1 2025, with averages of $4.13 in January, $4.19 in February, and $4.12 in March. This is a significant jump compared to the lower prices seen in late 2024 (e.g., $3.01 in December 2024). This consistent strength in natural gas is a huge deal for ExxonMobil.

What These Trends Mean for ExxonMobil's Business:

Immediate Boost (Upstream Resilience): While crude prices saw a slight dip in Q1 2025 from some previous highs, ExxonMobil's upstream earnings were still strong at $6.8 billion in Q1 2025, up $1.1 billion from Q1 2024. This was largely due to advantaged volume growth from the Permian and Guyana, and structural cost savings, which helped offset weaker crude realizations and refining margins.

Long-Term Strategy (A Crucial Diversification): While oil prices can be volatile, natural gas has proven more stable and has shown consistent growth. This is critical for ExxonMobil because natural gas makes up about 35% of their total production. As the world aims for lower carbon emissions, natural gas is often seen as a crucial "bridge fuel," meaning demand is expected to remain stable, potentially even robust, over the longer term. This substantial exposure to natural gas acts as a powerful long-term safeguard against potential instability in the crude oil market. It reduces their overall risk and provides a more consistent, growing revenue stream.

Refining and Chemicals Impact: In Q1 2025, ExxonMobil's Energy Products (refining) earnings were lower than Q1 2024, impacted by weaker industry refining margins, though partially offset by other factors. Chemical Products also saw lower earnings due to weaker margins and higher expenses from turnaround activities. This highlights how different segments can fluctuate, but the integrated model helps balance overall performance.

How ExxonMobil Navigates These Market Swings:

ExxonMobil isn't just passively affected by these market trends; they've built a smart strategy to manage them:

Diverse Business Lines:

This is their "integrated model" in action. They don't just drill for oil. They also refine it into products like gasoline and make chemicals. While refining and chemical earnings were lower in Q1 2025 compared to Q1 2024 due to market conditions, their diversified portfolio helps balance the overall impact of market fluctuations on any single segment.

Low-Cost Production:

ExxonMobil operates some of the most efficient and low-cost oil and gas fields in the world, notably in Guyana and the U.S. Permian Basin. Their average cost to break even across all their operations is around $40 a barrel, and they aim to lower this to $35 per barrel by 2027 and $30 per barrel by 2030. This means they can stay profitable even when other companies are struggling.

Strong Finances Get Stronger:

This is a virtuous cycle. When energy prices are favorable, ExxonMobil generates even more cash. This allows them to further reduce debt, build up their already impressive cash reserves, and reward shareholders through dividends and stock buybacks. This proactive strengthening of their balance sheet during good times prepares them for any potential future downturns and gives them immense strategic flexibility.

ExxonMobil's Resilience: How They Handle Market Extremes

To truly appreciate ExxonMobil's strength, let's re-examine two very different, extreme scenarios for oil prices in light of their Q1 2025 performance. You'll see how their unique structure allows them to navigate both bullish (high price) and bearish (low price) environments more effectively than most.

Scenario 1: Oil Prices Soar to $100 a Barrel (Imagine a Major Global Crisis)

Let's say a significant geopolitical event, like a crisis in the Middle East, pushes oil prices sky-high to $100 a barrel.

Explosive Profits: ExxonMobil's "upstream" (drilling) business would see a massive surge in earnings. Their super-efficient, low-cost assets in places like Guyana and the Permian Basin would generate enormous profits. Their production increased by 20% in Q1 2025 primarily due to the Pioneer acquisition in the Permian, indicating their capacity to capitalize on higher prices.

Increased Asset Value: The value of all the crude oil and natural gas they have stored would also significantly increase, potentially by billions of dollars.

Natural Gas Follows Suit: Historically, natural gas prices tend to rise alongside oil prices during crises. The strong natural gas prices seen in Q1 2025 would amplify this effect.

Rewarding Shareholders: With so much extra cash, ExxonMobil would likely use it to buy back even more of its own shares, increasing the value for existing shareholders. They might even consider a special, very large dividend payment. They'd also accelerate paying down any remaining debt, saving on interest costs.

A Small Catch: The only slight downside in this scenario might be for their refining and chemical businesses. When crude oil prices surge, it costs more to buy their raw material, which could squeeze profit margins for these segments if they can't raise their product prices fast enough. We saw weaker refining margins impact Energy Products in Q1 2025, which could be exacerbated in a high crude price environment if product prices don't keep pace.

Outcome in this Scenario: ExxonMobil's profits (Earnings Per Share, or EPS) could jump by 25-30%. They might even receive an even higher credit rating, solidifying their financial standing.

Scenario 2: Oil Prices Crash to $55-60 a Barrel (Imagine a Major Policy Shift)

Now, let's consider the opposite extreme: a hypothetical global policy shift that causes oil prices to plummet to $55-60 a barrel. This would be a real test of their defensive strength.

Upstream Squeeze, But Not Collapse: While their drilling and production earnings would certainly take a hit, their low-cost operations in places like Guyana (with its ~$35/barrel breakeven) would still remain profitable. They would likely prioritize these lower-cost projects and potentially defer higher-cost ones.

Downstream to the Rescue: This is where their "integrated model" truly shines. When crude oil prices crash, it means the raw material for their refining and chemical businesses becomes much cheaper. This would expand the profit margins for these segments, offsetting a significant portion of the losses from their drilling operations. While Q1 2025 saw weaker refining margins, lower crude input costs in this scenario would likely benefit them.

Strong Balance Sheet as a Shield: Their substantial cash reserves ($18.5 billion in Q1 2025) would be crucial. They declared a $0.99 dividend for Q2 2025, demonstrating their commitment to shareholder returns even with fluctuating prices. They'd probably slow down their share buyback program to conserve cash, but not stop it entirely.

Opportunity Knocks: Low-price environments can create opportunities for strong companies to expand. ExxonMobil might use this period to acquire smaller, struggling oil companies at a discount, as they did with Pioneer Natural Resources.

Potential Risk: If prices stayed very low for a long time, they might have to "write down" the value of some of their higher-cost oil reserves on their books, which could impact their reported asset value.

Outcome in this Scenario: ExxonMobil's profits (EPS) would decrease, but they would likely avoid cutting their dividend. Their stock would also probably perform better than companies that only drill for oil, demonstrating their superior resilience.

ExxonMobil's Built-In Advantages in ANY Scenario:

Integrated Business:

Their diverse operations across drilling, refining, and chemicals act like a built-in shock absorber, cushioning the impact of price swings. This is a huge advantage over "pure play" drilling companies.

Cost Leadership:

ExxonMobil is simply more efficient. Their very low operating costs (with an average breakeven of around $40/barrel across their portfolio, aiming lower by 2030) mean they stay profitable even when others can't. They achieved $12.7 billion in cumulative structural cost savings versus 2019 by Q1 2025.

Massive Financial Cushion:

That $18.5 billion in cash at the end of Q1 2025, combined with their excellent AA credit rating, means they can comfortably withstand adverse market conditions for years without having to sell off valuable assets. This financial strength isn't just a number; it's a strategic asset that gives them unparalleled flexibility to act aggressively in good times and defend effectively in bad times.

Natural Gas Protection:

The consistent strong performance and growing importance of natural gas acts as a powerful offset to any weakness in oil prices, providing a stable earnings stream.

Guyana & Permian Growth:

The rapid increase in low-cost oil production from Guyana and the expanded Permian production (up 20% in Q1 2025 due to the Pioneer acquisition) are game-changers. Whether oil prices are high or low, these incredibly low production costs ensure they remain profitable and generate significant cash flow. These projects dramatically improve ExxonMobil's long-term production profile and guarantee a sustained source of free cash flow for decades to come, supporting shareholder returns and future investments.

Is ExxonMobil a Good Investment? What the Numbers Say

Now, let's talk about the stock itself and whether it makes sense to put your money into ExxonMobil.

ExxonMobil shares were recently trading around $112.48. Experts estimate its fair value to be around $139.34, suggesting it could go up by nearly 24%.

What Makes It Attractive:

Good Value: Its Price-to-Earnings (P/E) ratio is lower than the industry average, meaning you're paying less for each dollar of earnings compared to similar companies.

Reliable Dividend: They offer a secure 3.5% dividend yield, and they've been paying dividends for an amazing 55 years straight! They declared a $0.99 dividend per share for Q2 2025. This is a big plus for investors looking for regular income.

Share Buybacks: The company is also buying back its own shares, having repurchased $4.8 billion in Q1 2025 as part of its $20 billion annual share buyback program through 2026. This can help boost the stock price over time.

Profitable Business: ExxonMobil is very profitable, with good returns on equity (ROE of 14.18% in Q1 2025) and assets. They make a lot of money (Q1 2025 earnings were $7.7 billion), which helps support those dividends and buybacks.

Safe Dividend: The company's payout ratio for dividends was 48.98% in 2025 (annualized), meaning they have plenty of money left over. This, combined with their strong cash reserves and low debt, makes their dividend very safe.

Things to Consider:

Short-Term Earnings Context: Q1 2025 earnings were $7.7 billion, compared to $8.2 billion in Q1 2024. While a slight decrease year-over-year, it was impacted by weaker industry refining margins and lower crude prices compared to the same period last year, offset by strong volume growth and cost savings. This is common in a cyclical industry.

Growth Forecast: Analyst forecasts predict a 21.40% EPS growth for next year (FY 2025). This positive outlook for future growth is driven by their cost efficiencies and major project startups.

Market Position and Sentiment: ExxonMobil's stock is known to be less volatile than the overall market (Beta of 0.46), which means it tends to swing less dramatically. This makes it a good "defensive" stock. Because its current price is below its estimated fair value and its 52-week high, it suggests there's a good safety margin for investors.

Overall Investment Recommendation…

Keep reading with a 7-day free trial

Subscribe to The Merchant's News to keep reading this post and get 7 days of free access to the full post archives.